When someone close to you dies, you expect grief, paperwork, and long phone calls with banks and solicitors. What most families do not expect is a tax authority asking detailed questions months later. Yet that is happening more often across the UK. Over the past year, HMRC inheritance tax scrutiny has noticeably increased, and many executors are finding probate far more demanding than they imagined. For years, people assumed inheritance tax investigations were only for wealthy estates or large country houses. That assumption is no longer safe. HMRC inheritance tax scrutiny now affects ordinary families whose main asset is a home and modest savings. If you have been named as an executor, or you are waiting to inherit, you are now part of a process that requires accuracy, evidence, and patience.

In practical terms, HMRC inheritance tax scrutiny means the tax authority checks what families declare instead of simply accepting the figures. Property prices, bank transfers, pension payouts, and even gifts made years before death may be compared with official records. Executors may be asked to justify valuations or provide documentation they did not realise was necessary. The aim is to confirm the correct tax is paid, but the process can feel intimidating if you are unprepared. Understanding what HMRC looks for helps you avoid unnecessary delays, penalties, and stress during probate.

HMRC Intensifies Inheritance Tax Scrutiny

| Area | Key Facts | What Executors/Beneficiaries Should Do |

|---|---|---|

| Nil-rate band | £325,000 generally tax-free | Confirm total estate value |

| Residence nil-rate band | Up to £175,000 extra if home passes to direct descendants | Provide inheritance evidence |

| Tax rate | 40% above thresholds | Calculate liability early |

| Gifts within 7 years | Potentially taxable | Record transfers and dates |

| Reporting forms | IHT205 or IHT400 | Choose correct form |

| Property valuation | Checked against market data | Use professional valuation |

| Payment deadline | 6 months after death | Prepare funds |

| Penalties | Interest and fines possible | Keep documentation |

Probate in the UK has changed. It is no longer just a formal procedure handled quietly in the background. The tax authority now checks information carefully and asks questions when figures do not match official data. Executors must treat the role seriously and keep thorough records. Beneficiaries should be patient and supportive while enquiries are resolved. When handled properly, estates still pass to the next generation smoothly, but accuracy and transparency now matter just as much as the will itself.

Why HMRC Is Increasing Investigations

- There is a straightforward explanation. Property prices have risen significantly while tax thresholds have remained frozen. As a result, more estates are drifting into the taxable range each year. A house purchased decades ago for a modest price may now be worth several hundred thousand pounds. That alone can push an estate into inheritance tax territory. Naturally, the government wants accurate reporting.

- Technology has also changed enforcement. HMRC now cross-checks probate declarations with Land Registry data and financial records. If a house is declared at a value well below nearby sales, the system highlights it. That is why HMRC inheritance tax scrutiny is becoming more common. It is not random. It is data driven.

What Triggers an Estate Review

Many reviews start from small inconsistencies rather than major wrongdoing. Even honest mistakes can lead to enquiries.

Typical triggers include:

- Property values lower than comparable sales

- Large withdrawals before death

- Missing accounts or investments

- Unclear lifetime gift records

- Incorrect probate forms

Often the first contact is a simple letter asking for clarification. But if explanations are incomplete, the enquiry can expand. Increasing HMRC inheritance tax scrutiny means documentation now matters more than ever.

The Executor’s Legal Responsibilities

Being an executor sounds administrative. In reality, it carries legal responsibility. When you sign probate forms, you confirm the information is accurate.

An executor must:

- Identify every asset

- List all debts

- Declare savings and investments

- Report gifts made before death

- Ensure inheritance tax is paid

Even if a solicitor assists, the legal responsibility stays with the executor. Under growing HMRC inheritance tax scrutiny, errors can create personal liability. If tax is underpaid, HMRC may pursue the executor directly. Because of this, careful record keeping is essential. Bank statements, pension details, property documents, and insurance information should all be collected early.

What Beneficiaries Need to Understand

Beneficiaries often focus on when they will receive money. However, tax compliance affects them too.

Important points:

- Probate may pause during a review

- HMRC may request family information

- Distributed money might need repayment

In certain situations, beneficiaries can be asked to help cover unpaid tax if the estate funds are insufficient. Increased HMRC inheritance tax scrutiny means cooperation between executors and beneficiaries is vital.

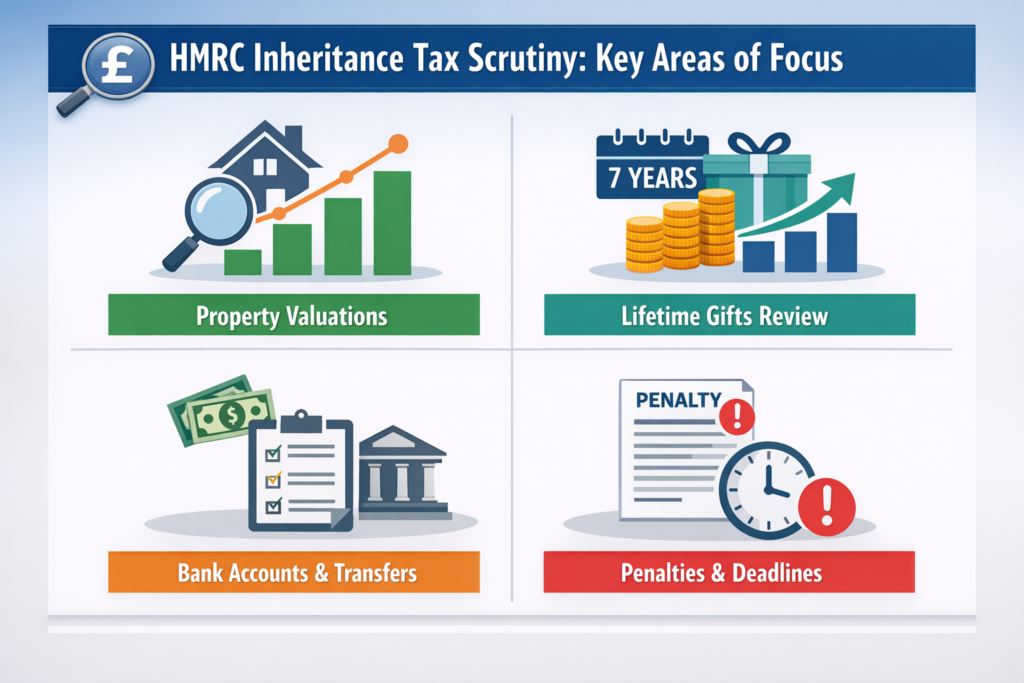

Property Valuations the Most Common Dispute

Property valuation disputes are the most frequent cause of enquiries. Families sometimes rely on informal estate agent estimates. HMRC may not accept those. Instead, the valuation office compares declared figures with recent local sales. If a property appears undervalued, HMRC may adjust the value.

Consequences can include:

- Additional tax

- Interest charges

- Delayed probate

To reduce risk HMRC Intensifies Inheritance Tax Scrutiny, a written valuation from a qualified surveyor is often advisable, especially if the property needs repairs or has unusual features affecting its price.

Lifetime Gifts and the Seven Year Rule

Many people believe giving away money automatically removes it from an estate. The rules are more complex.

Key facts:

- Gifts within seven years may be taxed

- Tax decreases over time

- Some annual exemptions apply

Regular transfers to children, help with home deposits, or forgiven loans may all be reviewed. During HMRC inheritance tax scrutiny, bank records are often requested to confirm when gifts occurred. Without documentation, proving exemption can be difficult.

Penalties Interest and Delays

Inheritance tax is usually due six months after the month of death. After that date, interest begins to accrue.

Possible consequences include:

- Late payment interest

- Financial penalties

- Extended investigation

- Distribution delays

Most penalties happen because of missing information rather than deliberate wrongdoing. However, modern HMRC Intensifies Inheritance Tax Scrutiny leaves little margin for assumptions.

Practical Steps to Avoid Problems

Preparation can make probate significantly easier.

Helpful actions:

- Collect bank records early

- Confirm pension details

- Identify all accounts

- Record gifts clearly

- Obtain professional valuations

Keeping notes explaining how figures were calculated is also wise. If questions arise later, those notes become essential under HMRC inheritance tax scrutiny.

Planning Ahead for Families

Good estate planning during life helps everyone later. Executors often struggle because they cannot find financial records.

Practical measures:

- Maintain a list of assets

- Record gifts and dates

- Update wills regularly

- Tell executors where documents are stored

Families who plan ahead usually face fewer complications if HMRC inheritance tax scrutiny occurs after death.

Read More:-

FAQs on HMRC Intensifies Inheritance Tax Scrutiny

1. Does every estate get investigated

No. Many estates pass without a detailed review, but checks are becoming more common where valuations or gifts appear unclear.

2. How long can an enquiry take

Simple checks may finish within weeks, while complex cases can take several months depending on the information required.

3. Do small estates pay inheritance tax

Generally, not if they remain below the tax thresholds, though HMRC can still verify the declaration.

4. Can beneficiaries receive money before probate finishes

Executors should be cautious. Early distribution can cause problems if additional tax becomes payable later.